MEXICO CITY, April 1.- The Bajío has become Mexico's new manufacturing hub, thanks to a relatively better-educated workforce, improved security and good infrastructure, noted U.S. analyst firm Stratfor.

The firm's text points out that Mexico's manufacturing sector has become more sophisticated under the North American Free Trade Agreement (NAFTA), making more value-added products, such as automotive, aeronautics and electronics, and now does so outside the traditional U.S.-Mexico border region.

"As the country's economy has grown, a secondary manufacturing core has emerged in the central lowlands, also known as the Bajio," a region Stratfor described as located near the area with most of Mexico's educated workforce, safer than many border cities, and now more efficiently connected to U.S. and Asian suppliers and consumers in the U.S. and Canadian markets.

The manufacturing sector in this region, the consultancy notes, will grow in importance in the coming years, although it will not entirely replace the border region.

The firm recalled that in the late eighties and early nineties, Mexico underwent a profound economic and political reorganization. The liberalized economy, culminating in NAFTA, and the privatization of large state-owned companies, transformed Mexico from an economically and politically closed system into an export-oriented industrial activity.

Low-tech factories, known as maquiladoras, sprang up in the border states of Baja California, Sonora, Chihuahua, Coahuila, Nuevo Leon and Tamaulipas, thanks to an abundant supply of cheap labor from other parts of Mexico.

Advantages

At the end of the 20th century China's "special economic zones" became competitors to Mexican factories in production costs and, according to Stratfor, Mexico responded by manufacturing more valuable products.

"While apparel exports declined 43 percent (from $7.6 billion to $4.3 billion) between 2002 and 2012, auto exports increased 152 percent (from $27.9 billion to $70.3 billion) and electronic sales increased 73 percent (from $43.3 billion to $74.9 billion) in the same period. Despite Asian alternatives, these Mexican products remained cost-competitive due to NAFTA."

Systemic effect

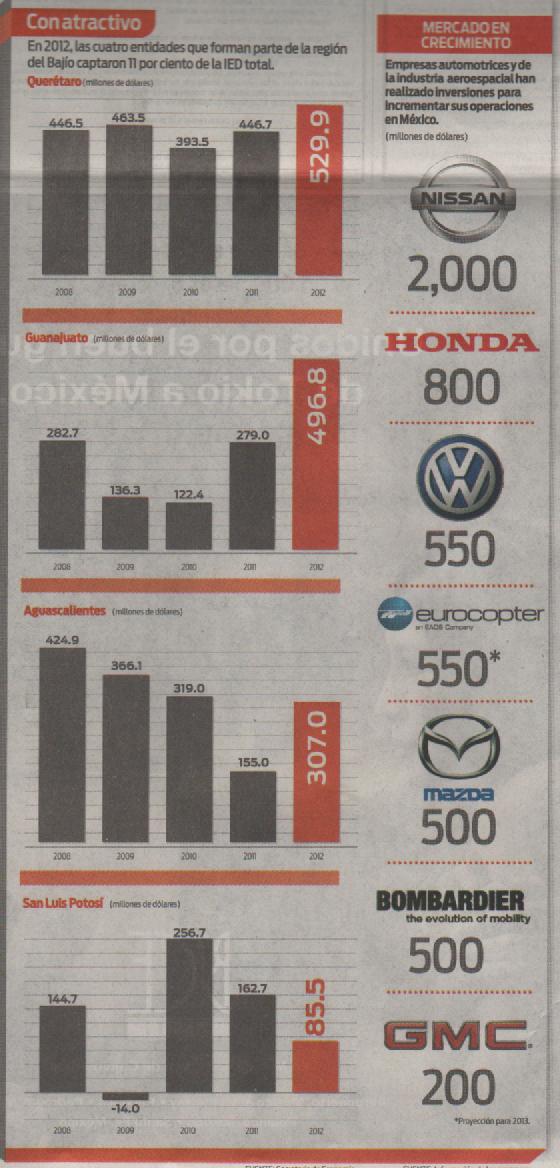

These figures represent a systemic change, Stratfor stressed: in Baja California, Coahuila, Chihuahua, Sonora, Nuevo León and Tamaulipas there were four percent fewer factories in 2011 than in 2007; but in Aguascalientes, Guanajuato, Querétaro, San Luis Potosí and Jalisco there were 12% more factories.

"Investment has followed a similar trend," the source stated. Total foreign direct investment in the Bajio increased from $7.2 billion in 1993-2002 to $16.3 billion in 2003-2012. In comparison, foreign direct investment in border states during the same period increased from $32.9 billion to $55.2 billion.

This is not to say that there is a shift of factories from the border to the Bajio, but rather that new companies seeking to enter the North American market, especially European and Asian automakers, are increasingly setting up shop in the area of reference.

Infrastructure

For Stratfor, the Bajio became attractive for manufacturers after Mexico renovated its transportation infrastructure. More and more raw materials come from Asia, and most automotive exports move by rail.

Therefore, Mexico had to expand its Pacific ports and its rail connection to the industrial base and consumer markets, he says.

"The Pacific ports, Manzanillo and Lazaro Cardenas are therefore booming. Lazaro Cardenas, Mexico's only port with post-Panamax ship capacity, is the fastest growing port in North America," he stressed.

In addition, the railroads connecting these ports to the U.S. have become much more efficient since they were privatized in 1995. The total length of the country's rail network has remained at around 26.7 thousand kilometers, but the amount of cargo transported has doubled, from 52.5 million tons to 108.8 million tons per year.

In the consulting firm's opinion, more investment in manufacturing and production will bring the industrial core closer to Mexico City and populations in need of jobs.

Manufacturing in the Bajio will not replace activity at the border, but it will give Mexico an opportunity to develop in a more uniform and sustainable manner.

Comprehensive progress

According to the Ministry of Economy, the development observed in the Bajío region qualifies it as one of the fastest growing industrial zones in the country and in Latin America.

In fact, economic analysts agree that given the zone's progress, new infrastructure is required, including industrial warehouses, housing and more services.

Luis Zárate Rocha, president of the Mexican Chamber of the Construction Industry, said that the expansion of the aerospace, automotive and food industries, among others, has led to a significant demand for housing, so it is expected that around one third of the housing to be built in the country in the next six years will be located in the Bajío.

In this regard, Infonavit estimates that there are around 30 housing developers registered in the Bajío region, among them: Urbanizadora y Promotora María de la Luz, Inmobiliaria Dos Plazas, Urbi and Davivir Desarrollos Inmobiliarios, among others.

The specialists explained that as part of the development inertia in this region, franchises are another segment that is finding an important market niche.

The firm, Gallástegui Armella Franquicias has observed that Guanajuato and Querétaro are two entities where the greatest increase in franchises is observed.

Food is one of the branches with the highest demand, although health, beauty, laundry and languages, among others, already have an important presence.

Source: Excelsior