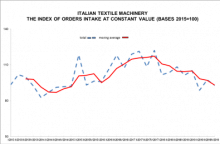

State of the Industry Report 2019: Italian textile machinery orders down for Q4 2019

The orders index for textile machinery drawn up by ACIMIT, the Association of Italian Textile Machinery Manufacturers, for the period from October to December 2019, showed an 8% drop compared to the same period for 2018. The index value stood at 92.9 points (basis: 2015=100). Orders compiled by Italian machinery manufacturers were in negative figures both abroad and on domestic markets in Italy. An 8% slide was recorded abroad, with the absolute value of the index standing at 89.4 points. On the other hand, the drop in order collection on the domestic market stood at 7%, compared to the fourth