THIS INTERNATIONAL ON DEMAND SUMMIT IS AN INDUSTRY… More

Mexico’s Growing Packaging Industry

With a population of 120 million, political and financial stability, 12 trade agreements with 44 countries, and the North American Free Trade Agreement in renegotiation – Mexico’s economy is slated for more strong growth in 2019.

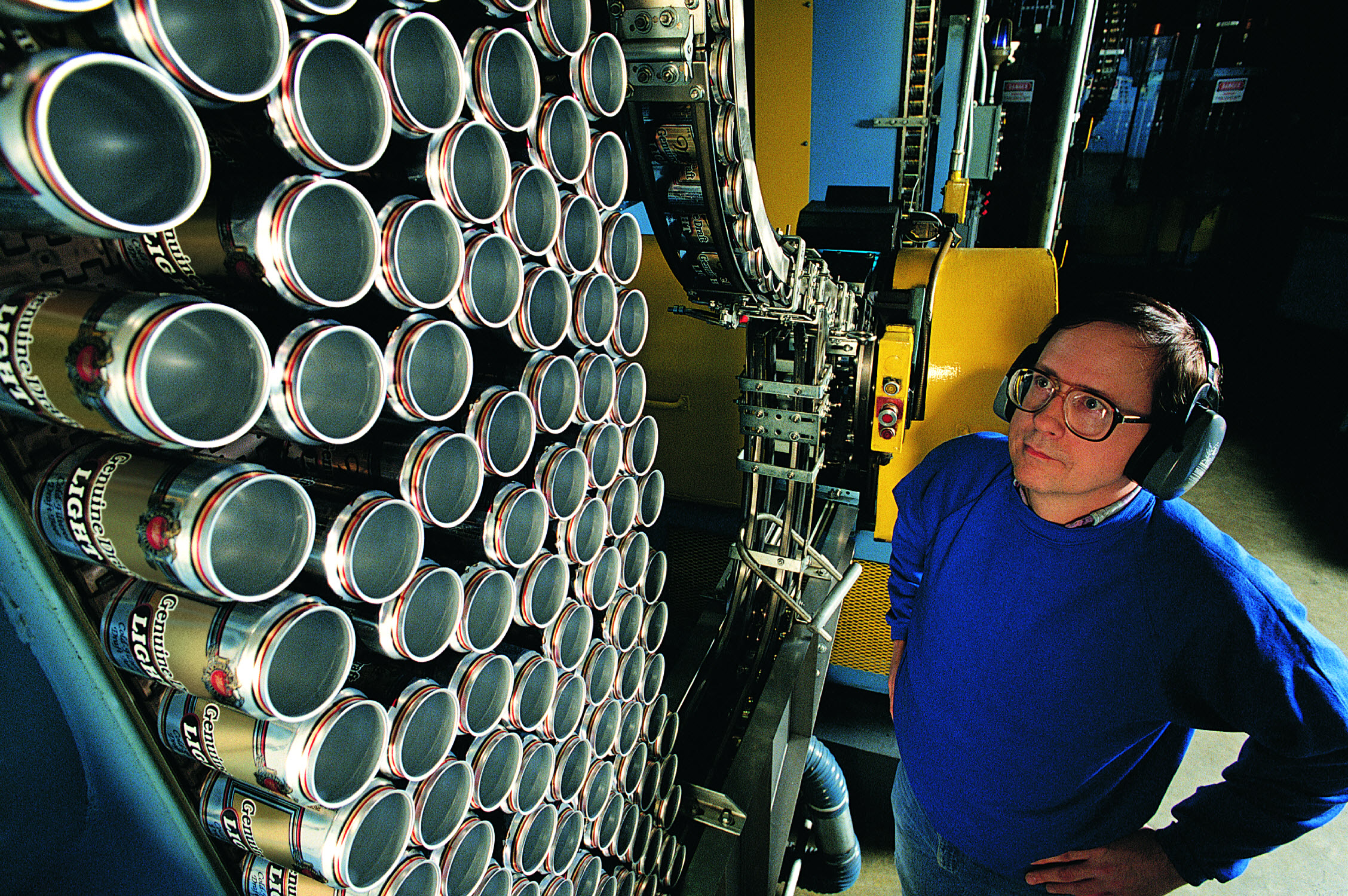

Mexico is a big consumer of packaging materials and technology, particularly in the food and beverage industry, followed by the pharmaceutical and personal care sectors. The popularity of carbonated drinks and alcoholic beverages, as well as the eating habits and personal care of the Mexican population, generate a high demand for packaging and packaging machines. In 2017, the Mexican packaging sector accounted for 5.8% of industrial GDP, 8.6% of manufacturing GDP, and 1.7% of national GDP.

The national production of packaging and packaging machines, however, is practically non-existent, and Mexican buyers looks to Europe or the United States when purchasing these technologies. In fact, a great variety of brands from different countries such as Italy, Canada, China, Taiwan, Korea, Spain, Norway, Belgium, and Germany are currently available on the market. Mexicans importers/distributors eagerly seek European packaging and technology solutions to offer to local clients. These intermediaries are generally small companies that sell and supply new parts and spare parts for imported machines. In a few cases, they are able to offer turnkey engineering and integration solutions for larger operations.

In 2017, Mexico imported $700 million worth of packaging machinery. The machines that fill, close, plug, or label bottles, jars, or milk represent the main import items, making up 48% of total imports in the sector, followed by the machines that wrap and shrink films, with a share of 35%.

In 2017, Mexico imported $700 million worth of packaging machinery. The machines that fill, close, plug, or label bottles, jars, or milk represent the main import items, making up 48% of total imports in the sector, followed by the machines that wrap and shrink films, with a share of 35%.Italy’s market share of the Mexican imports of packaging machinery was approximately $150 million in 2017, +11.24% when compared to 2016.

Increasingly, Mexico’s manufacturing companies are demanding highly advanced automated yet flexible solutions that can allow them to handle a wide range of packaging materials, designs, and product specifications.

The Mexicans value the ingenuity of Italian makers, which provides innovative turn-key solutions that reduce energy consumption, waste, and the number of materials used for packaging. Sustainability has become a critical issue. Extending the shelf life of products, and achieving the highest standards of hygiene and food safety are also important aspects of technology. The decision makers of Mexican companies appreciate technologies that are able to constantly monitor the machinery’s performance, safety levels, temperatures, energy consumption, and vibrations. IIOT, remote monitoring, and predictive maintenance, automation are changing the manufacturing industry in Mexico. These technologies are becoming more popular and accessible than ever to medium-sized companies.

The findings above stem from a series of studies of Mexico’s packaging industry which were conducted by Italian Trade Commission (ITA) office in Mexico City and UCIMA, the Italian Packaging Machinery Manufacturers' Association.

To request copies of the reports please contact machinesitalia [at] ice.it ?subject=Machines%20Italia%20E-newsletter">machinesitalia [at] ice.it

Related Articles:

Recent News

POSTED ON