State of the Industry Report 2019: Italian Textile Machinery Market

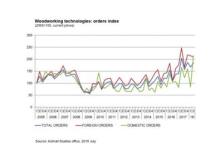

New orders for Italian machinery manufacturers were negative both in foreign markets and in Italy. Abroad, an 8% decrease was recorded, with an absolute index value of 98.9 points. The drop in domestic orders was even more pronounced, at -22% compared to the third quarter 2018. The absolute value of the index was 94.9 points. Alessandro Zucchi, president of ACIMIT, commented the market situation: "The orders index for the textile sector provides a true picture of the global market’s downsizing. Current geopolitical tensions are undermining the climate of trust for businesses that need to